And Employers tax deduction on contributions to PRS made on behalf of their employees above the EPF statutory rate up to 19 of employees remuneration. The following Capital Gains Tax rates.

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

PRS Annuity Premium Reliefs If the taxpayer who has contributed the PRS annuity premium will entitle a max relief of RM300000 The withdrawal before the age of 55 years the taxpayer will be subject the withholding tax of 8.

. Details of the 2017 property tax payable for HDB flat owner-occupiers is as below. PRS allows you to enjoy the RM3000 tax relief regardless of when you invest the money as long as it is within the calendar year. Individuals tax relief of up to RM3000 for the first 10 years from assessment year 2012.

The overall personal income tax relief cap of 80000 takes effect from YA 2018. A Death b Permanently leaving Malaysia. Floor 3 1 St Ann Street Manchester M2 7LR.

Property Tax 2017. Loh Associates 30 31. The PRS Tax Relief was specially introduced to encourage you to save more for your retirement.

The Internal Revenue Service the Service will not assert that cash payments an employer makes to 170c organizations in exchange for vacation sick or personal leave that its employees elect to forgo constitute gross income or wages of the employees if the payments are. As the total amount of personal reliefs claimed by Mrs Chua exceeds the overall relief cap of 80000 the total personal reliefs allowed to her is capped at 80000 for YA 2018. The Specific Relief Amendment Bill 2017.

2017 Property Tax Payable. Before the age of 55 as long as youve been a PRS Member for at least one year you may make pre-retirement withdrawals for general purposes from Sub-Account B which holds 30 of your PRS savings. Download Document 196 MB.

A tax exemption is also provided on income received by the funds under the Schemes. 6 April 2016 to 5 April 2017. 1 made to the 170c organizations for the relief of victims of the 2017 California.

24 rows Tax relief refers to a reduction in the amount of tax an individual or company has to pay. In order to ensure the welfare of retirees upon reaching retirement. The Union Territory Goods and Services Tax Bill 2017.

Unless the contributor. Provide additional tax relief for those affected by Hurri-cane Harvey Irma or Maria and tax relief for those affec-ted by other 2017 disasters such as the California wild-fires. PRS Income Tax Relief.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. The good news is an individual who makes contribution to his or her PRS funds is allowed to claim personal tax relief of up to RM3000 by the Inland Revenue Board of Malaysia. It was introduced in Lok Sabha on January 2 2018 and was passed by the house on July 23 2018.

Ever-changing regulations the new stamp duty surcharge the. All property owners will be receiving their property tax bills by end December 2016 and they are reminded that the property tax for 2017 is payable by 31 January 2017. 10 for gains qualifying for Entrepreneurs Relief.

Extend certain tax benefits that expired at the end of 2016 and that currently cant be claimed on your 2017 tax return such as. To ensure private sector employee and self-employed to have sufficient savings upon retirement. Besides being an additional retirement pot the PRS is also income tax deductible.

The amount of tax relief 2017 is determined according to governments graduated scale. The Private Pension Administrator PPA is working with the government and related authorities to encourage individuals to save more for their retirement its CEO Husaini Hussin said at The Edge-Kenanga Retirement Forum 2018 in Penang recentlyFor instance he said the government is looking to extend the tax relief of up to RM3000 given to individuals who invest. 28 for Capital Gains.

So why not make good use of the money first in the beginning of the year be it to invest in share market. It is worth noting that because banks and building societies no longer deduct tax at source from most payments of interest PRs who before 6 April 2016 might not have had to file a return may now be obliged to do so but HMRC has announced that for 201617 and 201718 at least if interest is the only source of estate income and the tax liability is less than 100 it is not. Aug 4 2017 1 min read.

Tax Relief for Resident Individual Year 2017 No. AS INTRODUCED IN LOK SABHA Bill No. Individual Relief Types 1.

Tax assumptions may change if the law changes and the value of tax relief if any. The Indian Institutes of Information Technology Amendment Bill. PRS Legislative Research is licensed under a Creative Commons Attribution 40.

View Notes - Chapt 3 - Tax Relief 2017pdf from HR 602 at University of Notre Dame. The PRS REIT is a leading provider of Private Rented Sector housing. This relief is applicable for Year Assessment 2013 and 2015 only.

The integrated goods and services tax bill 2017 - PRS Mar 23 2017 - online information and database access or retrieval. This tax incentive is available until assessment year 2025. The Goods and Services Tax Compensation to States Amendment Bill 2017.

Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the purpose to reduced the burden of tax payers. Hence the total amount of reliefs claimed by Mrs Chua is not capped for YA 2017. The credit for nonbusi-.

View our 2017 annual report. Earnings generated by the PRS funds will also be exempted from tax charges. Such withdrawals can be made once per calendar year and are subjected to an 8 tax penalty on the withdrawn amount.

58 of 2017 THE INTEGRATED GOODS AND SERVICES TAX BILL 2017 ARRANGEMENT OF CLAUSES CLAUSES CHAPTER I PRELIMINARY 1. You will be able to deduct up to RM3000 from your taxable income which will count towards your final tax payable. I announced a tax relief up to RM6000 for EPF and life insurance be extended to the Private Pension Fund now known as Private Retirement Scheme.

In the 2011 Budget. PRS Yields Monthly Report. The Negotiable Instruments Amendment Bill 2017 passed by Parliament.

Internal Revenue Bulletin 2022 13 Internal Revenue Service

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

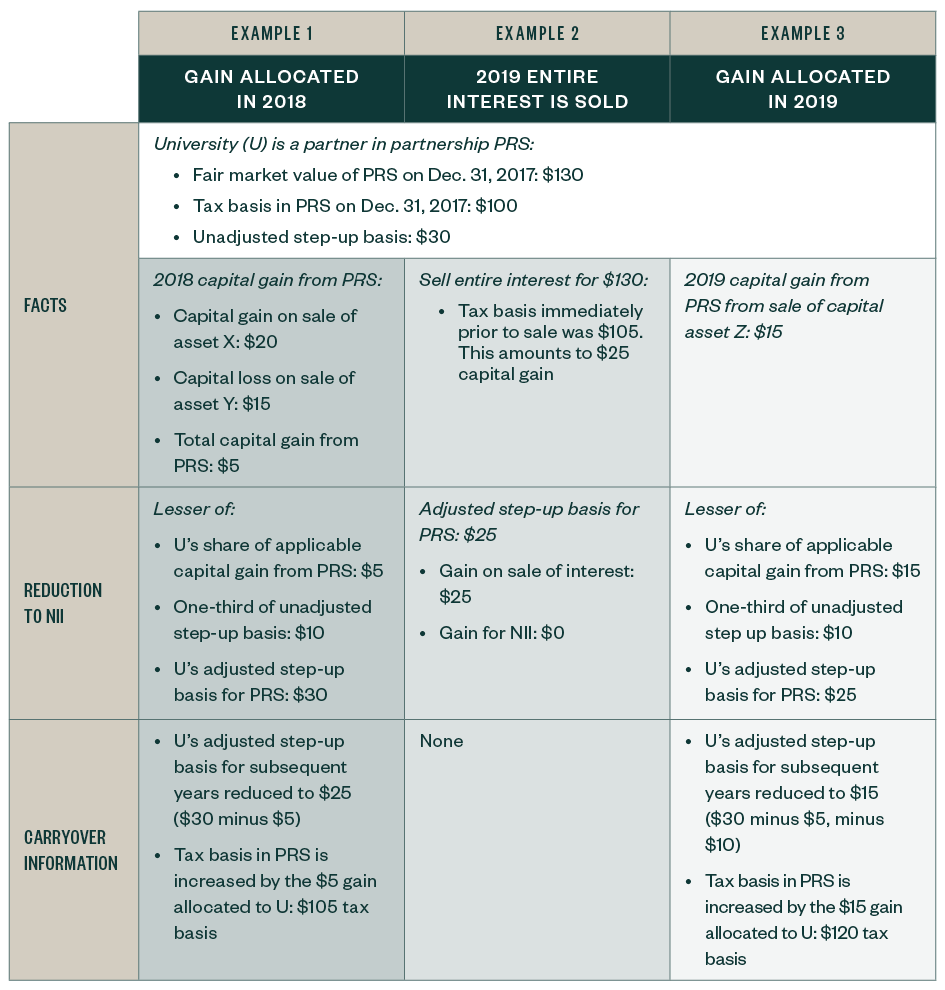

Irs Issues Net Investment Income Tax Guidance For Higher Ed

Sec Filing International Flavors Fragrances Inc

Federal Register Limitation On Deduction For Business Interest Expense Allocation Of Interest Expense By Passthrough Entities Dividends Paid By Regulated Investment Companies Application Of Limitation On Deduction For Business Interest Expense

Private Retirement Scheme Prs 2017 Prs Youth Incentive Enhanced Features Pursuant To Budget 2017 The Prime Minister Had Announced That The Government Will Contribute Rm1 000 From The Existing Rm500

Excuse Me Have You Started Prs Power Wealth Consultancy Facebook

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live